Advertising spending for the first three quarters of 2006 rose 5.1% over the same period last year, due to ad spending increases across many major media, according to Nielsen Monitor-Plus. Ad spending increased in most reported media, led by the Internet (49.2%), Spanish Language-TV (16.6%) National Newspapers (8.4%) and Spot TV Top 100 Markets (7.4%). Growth in several media remained relatively flat or decreased year over year including smaller Spot TV markets, B2B magazines, Local Newspapers, and Spot and Network Radio. The recent midterm elections have contributed significantly in increased ad spending in the top 100 television markets, and because all the political ads were local, it led to an uplift in Spot TV ad revenues, particularly in Q3.

Online spending increased an impressive 49.2% over the two time periods.

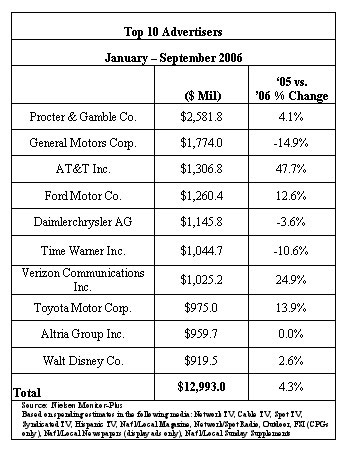

Ad spend for the top 10 companies reached 12.9 billion, up 4.3% from last year. Most major advertisers experienced growth. AT&T and Verizon, both Telephone Services companies, showed the greatest percent growth in terms of percent, at 47.7% and 24.9%, respectively.

A portion of this increase is due to M&A activity. Specifically, since the acquisition of AT&T by SBC Comm., and the re-branding of SBC as AT&T, ad spending has grown significantly this year. Also this year, Verizon completed its buy of MCI and increased ad spending for the year. In addition, both companies greatly increased their spending in their Internet Service/Web Access business units.

Offsetting these significant increases, two of the three auto advertisers cut ad spending. Specifically, GM a spending was down 15% and Daimlerchrysler had decreased its ad spend by 3.6%., while Toyota increased spending by 14% over the same period a year ago.

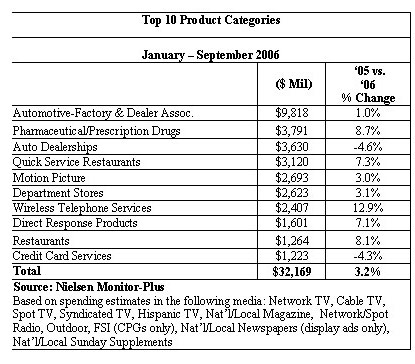

Spending for the 10 largest categories reached 32.1 billion in the first nine months of the year, 3.2% greater than the same period last year. Most product categories have increased spending, with the exception of Auto Dealerships (-4.6%) and Credit Card Services (-4.3%). The Wireless Telephone Services industry is the fastest growing in terms of percent increase over last year (12.9%). The Automotive category (comprised of Factory & Dealer Associations) is still the top spender, reaching almost 10 billion for the first nine months. However, growth was just slightly positive at 1%, due largely to Local Dealership declines of 4.6%.

Both charts based on spending estimates in the following media: Network TV, Cable TV, Spot TV, Syndicated TV, Hispanic TV, Nat'l/Local Magazine, Network/Spot Radio, Outdoor, FSI (CPGs only), Nat'l/Local Newspapers (display ads only), Nat'l/Local Sunday Supplements.